In just about every business banking organization, the teller works because the experience in the banking institution. They are well-trained workers who are responsible for effective customer satisfaction and monetary transactions finalizing. Probably the most teller window typical ways of processing monetary deals is via the teller home window. The teller home window is effective, useful, and continues to be the best method for fast and dependable purchases for financial customers. On this page, we’ll explore precisely why the teller windowpane is one of the most efficient aspects of the banking market.

For starters, the teller windowpane makes it simple for consumers to pull away and put in cash. Envision wandering in to a lender and discovering you can’t withdraw your cash due to been unsuccessful Cash machine purchases. Together with the teller home window, these kinds of concerns are unknown. The performance of the teller window is the fact it’s always willing to make withdrawals and build up for any kind of account. Whether or not it’s income, inspections, or possibly a direct deposit, financial purchases are smoothjng throughout the teller windows with no postpone. The teller can also approach funds orders placed, traveler’s inspections, and banking institution drafts inside a small amount of time structure.

Second of all, the teller window allows customers gain access to different account professional services. Account services like altering the account pin, trying to get credit or personal loans, and starting or shutting down your account are successfully done in the teller windowpane. This fast and effective service has received a significant effect on the financial industry mainly because it really helps to increase customer happiness.

Thirdly, the teller windows will allow for consumers to get any required support. Tellers are generally knowledgeable about financial institution goods, account types, as well as queries buyers probably have regarding their monetary credit accounts. They also supply assistance to aid clients comprehensive account purchases and make informed decisions. Since the teller windowpane is made for experience-to-deal with relationships, it allows tellers to swiftly recognize and tackle customers’ requirements.

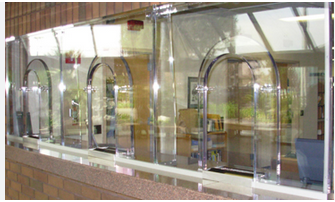

Fourthly, the teller windowpane is renowned for its top level of protection. Banking institutions are aware of the importance of retaining their clients’ funds harmless, and teller home windows are equipped with high-technology security actions that make sure customers’ safety. As opposed to ATMs that can be subjected to skimming and hacking, the teller windows is handled and managed by supervised staff, offering clients with assurance.

To put it briefly:

The teller home window is the ultimate strategy to successful banking deals. From fast digesting as well as other bank account services to extra help and-security procedures, it makes certain to fulfill consumer requires and anticipations. The teller windows can also be equipped with the most recent banking technologies, delivering customers with the best of services. It’s crystal clear that banking institutions that prioritize client satisfaction and fast purchases should take hold of the teller windows as the best option. Its effectiveness is unequaled and has become probably the most trustworthy methods of finalizing deals inside the business banking business.