Digital technology has successfully revolutionized all aspects of our lives. It empowers us to do things beyond what we could previously imagine, including trading stocks online. Online trading has become a popular way for individuals to invest in various financial markets from the comfort of their own home. In this blog post, we will provide some basic information that will help you navigate the digital frontier of online trading.

1. What is Online trading?

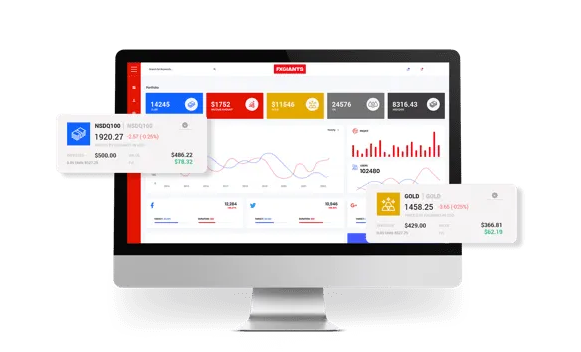

Online trading is buying and selling financial products such as stocks, currencies, options, and futures, through an online trading platform. These platforms are provided by brokers who act as intermediaries between you as a trader and the financial market itself. These platforms allow traders to see real-time price quotes, place orders, and manage accounts. As an online trader, you can buy and sell financial instruments at any time the markets are open.

2. Types of Trading Accounts

There are different types of trading accounts offered by online brokers. The most common are cash accounts and margin accounts. A cash account requires you to deposit the full amount of money necessary to buy a stock. Whereas, a margin account allows you to borrow money from the broker to purchase stocks and other financial instruments. However, margin trading comes with inherent risks, including potential loss more than the amount invested. Hence, traders need to understand their risk tolerance and carefully evaluate the margin account terms and conditions.

3. How to Trade Online?

To start trading online, you need to have a computer or mobile device, and an internet connection. You then need an online broker account and must provide financing for the account by transferring funds from your bank account to the trading account. Once you have signed up with an online brokerage, you must download their trading platform and other supportive applications like charting tools, market news feeds, technical analysis systems, etc.

4. Best Practices for Online trading

Online trading carries risks, and the volatile markets require constant attention and updates. To be a successful online trader, you need to start with a well-defined trading plan that specifies your financial goals, risk tolerance, strategy, and criteria to make buy or sell decisions. Continuously monitor the market conditions and news, and manage your trades based on your trading plan. It is also essential to control your emotions and avoid impulsive trading decisions.

5. Benefits of Online trading

Online trading has numerous benefits, including convenience, flexibility, lower fees, real-time access to financial markets, and a vast range of financial instruments to invest in. You can monitor your portfolio and execute trades quickly and efficiently by using advanced trading tools and analytics. Moreover, online trading provides an equal opportunity for everyone to enter the financial market and grow their money.

Conclusion:

Online trading is an excellent way to invest in financial markets and earn money. However, it also carries significant risks and challenges that need to be carefully managed. By following the above tips on navigating the digital frontier of online trading, you can become a successful trader and achieve your financial goals. Remember, always do your research, keep informed, and stay disciplined. Happy Trading!